Household finances: Capital gains from real estate by entity

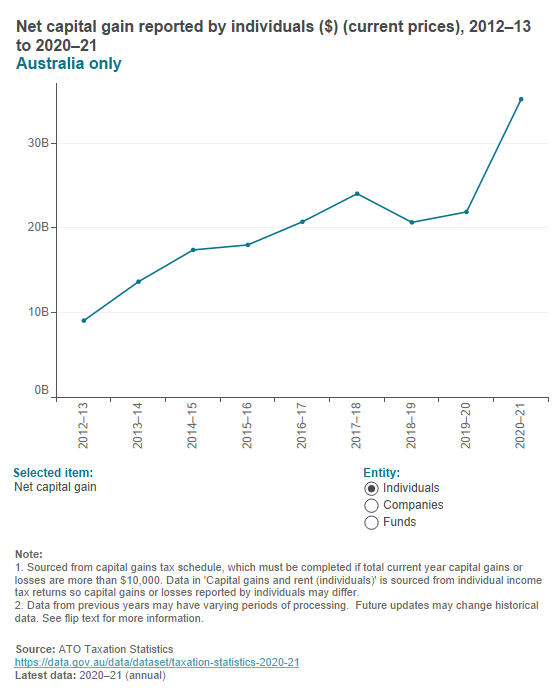

Net capital gain, capital gains and losses on real estate and all capital gains and losses of individuals, companies and funds for each income year since 2012–13 are published by the Australian Tax Office (ATO). Capital gain/loss refers to the difference between what a capital asset cost to acquire and what was received when it was disposed of.

The ATO produces annual taxation statistics providing an overview of the income tax status of Australian individuals, companies, partnerships, trusts and funds. Taxation statistics for capital gains by entity were sourced from capital gains tax schedule processed by 31 October of the following year. For example, data for the 2020–21 income year includes data processed up to 31 October 2022. The statistics are therefore not necessarily complete.

ATO data are also used in the following dashboard menu option: Capital gains and rent – individuals by postcode.

See ATO Taxation Statistics 2020–21 (https://data.gov.au/data/dataset/taxation-statistics-2020-21) for source data and data quality information. Source reference table: Taxation Statistics 2020–21, CGT – Table 1.